ACCOUNTING TUTORIALS

An overview of accounting principles in these useful accounting tutorials.

ACCOUNTING TUTORIALS

An overview of accounting principles in these useful accounting tutorials.

Introduction

Welcome to the QuickEasy software accounting tutorials.

This section of our website is aimed at non-accountants.

We’ve made these accounting tutorials for people with very little background in accounting theory but who want to learn. And want to do so as quickly as possible. You may be a business owner, general administrative staff, or anyone else who wants to understand accounting. Doesn’t matter who you are, if you want a quick and easy guide to accounting, you’re in the right place with these accounting tutorials.

We will start with a birds-eye view first, looking at details as we progress to the end of this accounting tutorial. In the first few chapters of the accounting tutorials, we’ll be looking at financial statements and thereafter more closely at more practical aspects toward the end.

In our accounting tutorials, we are using the word ‘accounting’ in the sense that most non-accountants understand it. That is, accounting is the task of collecting and sorting an organisation’s financial information.

At all times we will keep to plain and simple English.

The Goal of Accounting

Is there a goal in accounting? What is the end we are trying to achieve…

The Accounting Equation

The Accounting Equation looks like this: Assets (A) = Equity (E) + Liabilities (L) If…

Debits and Credits

Is there a goal in accounting? What is the end we are trying to achieve…

Double Entry Method

In previous sections we touched on the trial balance. It is important that this report…

Assets, Liabilities and Equity

Most people have heard of assets, liabilities and equity. Especially when they had dealings with…

VAT - The What and How

Value Added Tax (VAT) is often a somewhat mystical concept. In this tutorial we offer…

The Goal of Accounting

Is there a goal in accounting?

What is the end we are trying to achieve with all these rules and principles?

Yes, there is a goal. In QuickEasy's accounting tutorials, we understand that the goal of accounting is communication. Income statements, balance sheets, cash flow statements etc., all communicate some information to the people who read them. This is essentially what accounting comes down to.

Accounting takes everyday business transactions, records them and presents them in a standard form.

Two parts of this sentence need some explanation.

‘business transactions’: A woman walks into a shoe shop, picks up a pair of shoes she likes, walks to the counter and hands over some money. The cashier takes the money, puts the shoes in a bag and gives her a receipt. Both smile and the happy shopper walks out the door. We’ve all done something like this before. But what we might not realise is that we have just been involved in a business transaction.

‘records them’: Whether it is a handwritten invoice, cash register or fancy computer. These are all ways in which businesses record transactions. In the above transaction the cashier, when he gives the woman her receipt, has added this event into the shops accounting system.

Now as you can imagine, transactions take place every day; a few times a day for six or seven days a week and fifty-two weeks a year. Also, consider that other transactions are taking place during this time. The shop owner pays rent to the landlord, pays staff that help him in the store, buys the shoes from the distributor etc. At the end of the month or year, he has to give an account of his activities for that period.

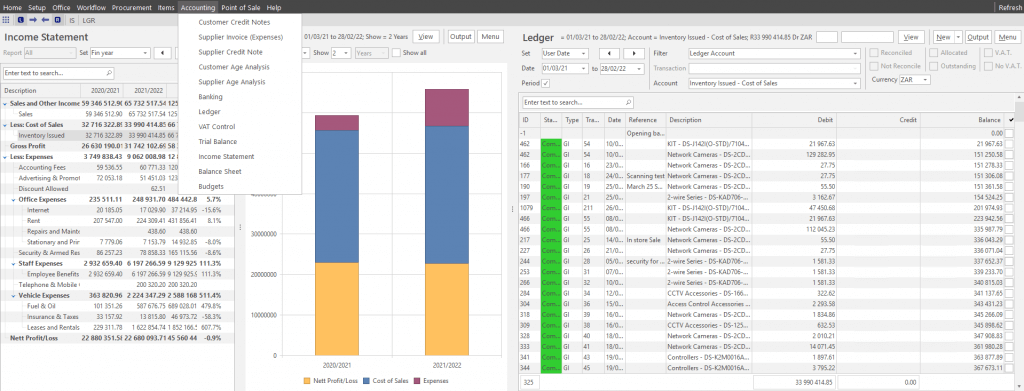

Below is an example of what this account of activities may look like:

This is an income statement.

You may have heard it called something else like ‘profit and loss statement’ or ‘statement of comprehensive income’. In essence, this ‘statement’ given by the owners and/or managers of the business is meant to give us an idea of how their business has performed.

For example, we can see how many other expenses the shoe shop incurred in making these sales and how much profit the business made after expenses by looking at cost of sales.

Some other standard forms include the statement of changes in equity, balance sheets, as well as more summarised forms of income statements.

So, who uses this kind of information?

There are two categories of parties who are interested in seeing this information. Those outside the business, but who have an interest in how the business performs, and those inside the business who need to manage the business. Let's look at some examples.

Examples of those outside the business include SARS which wants to know how much profit the business has made so that they can collect their share of its earnings and/or Banks who may have loaned money to the business. They want to make sure that the business will be able to pay back the loan.

Other examples are shareholders (owners of businesses who are not involved in the day-to-day functions of the business), customers, suppliers and staff.

People inside the business also need to keep track of how the business is performing. Information about past Sales, the Cost of those Sales, and Other Expenses incurred in producing that Income can all be useful information to any business owner or manager when compared to performances in the past or budgeted/targeted results.

It’s interesting to note that all of these formal statements look exactly the same. If you took the name of the business on the page above, you wouldn’t really know what the business does by looking at these standard reports.

On the other hand, information for business management tends to be informal and varied. Examples include sales reports by customer, product or region. Production reports and Costing reports. In fact, managers and owners could put the information in pretty much any form that helps them to better run their business.

In the next section of our accounting tutorials, we will look at some basic Accounting concepts and take a closer look at Trial Balances, Balance Sheets and Income Statements.

GAAP Compliant

The next portion of our accounting tutorials covers GAAP (pronounced GAP) which stands for Generally Accepted Accounting Principles. It is a group of commonly used accounting standards and principles that are used for Financial Reporting. These work to improve transparency and consistency in financial statements from one organisation to the next and are specific to the country and industry.

Is QuickEasy BOS GAAP Compliant?

Yes, BOS is GAAP compliant, in that it provides Financial Statements and Accounting reports based on generally accepted accounting principles.

When a company issues and distributes its Financial Statements to the public, showing revenue recognition, Balance Sheet item classification and outstanding share measurements, GAAP must be followed.

If a company uses GAAP and non-GAAP standards, it needs to identify the non-GAAP measures in Financial Statements and other public disclosures, such as press releases.

What are the GAAP Principles?

The Business Entity Concept

This principle means that the accounting for a business is kept separately from the personal financials of its owner, or from any other business or organisation.

This means that none of the owner's personal Assets is listed on the business Balance Sheet. The Balance Sheet of the business should only reflect the Financial Position of the business.

Also, whatever expenses the owner might have that are of a personal nature are not to be listed against the business's expenses.

The Continuing Concern Concept

This principle assumes that a business will continue to operate and the value of the Assets will reflect that.

However, if it is known that the business is going out of business, the values of the Assets will decline because they have to be sold under unfavourable circumstances. The values of such Assets often cannot be determined until they are actually sold.

The Principle of Conservatism

This principle implies that the accountant's evaluations and estimates during business affairs are fair and reasonable. They should neither overstate nor understate the affairs of the business or the results of the operation.

The Objectivity Principle

Objective records mean that when different people look at the evidence they will arrive at the same values for the transaction.

The source document for a transaction is usually the best objective evidence and shows the amount agreed to by the buyer and the seller, who are usually independent and unrelated to each other.

The Time Period Concept

This principle maintains that accounting takes place over specific time periods. These are known as fiscal periods. These fiscal periods are of equal length and are used when measuring the financial progress of a business.

The Revenue Recognition Convention

This principle provides that Revenue be recognised at the time the transaction is completed. If it is a cash transaction, the income is recorded when the sale is completed and the cash is received.

It is important to take Revenue into the accounts properly. If this is not done, the earnings statements of the company will be incorrect and the readers of the Financial Statement misinformed.

The Matching Principle

This is an extension of the Revenue recognition convention stated above. This principle states that each expense item (cost of sales) related to Income generated must be recorded in the same accounting period as the Revenue it helped to earn. This is to measure the results of operations fairly on the Income Statement.

The Cost Principle

This principle holds that the value recorded in the accounts for an Asset is not changed until later if the market value of the Asset changes. To change the original value of an Asset would take an entirely new transaction based on new objective evidence.

If objective evidence is not available, the transaction would be recorded at fair market value which must be determined by some independent means.

The Consistency Principle

This principle requires accountants to be consistent when applying the methods and procedures from period to period. If they change a method from one period to another, they should explain the change clearly on the Financial Statements. If there is no statement of change in Financial Statements, the readers can assume that consistency has been applied.

This prevents people from changing methods for the sole purpose of manipulating figures on the Financial Statements.

The Materiality Principle

This principle means that accountants use generally accepted accounting principles, except when doing so would be expensive or difficult, and were ignoring the rules will make no real difference. If a rule is temporarily ignored, the Net Income of the company must not be significantly affected, nor should the reader's ability to judge the Financial Statements be reduced.

The Full Disclosure Principle

This principle means that any and all information that affects the full understanding of a company's financial statements must be included with the financial statements.

If some items do not affect the ledger accounts directly, they can be included as accompanying notes.

The Accounting Equation

The Accounting Equation: Assets (A) = Equity (E) + Liabilities (L)

If you’ve spent any amount of time in an accounting course or classroom - or now with our accounting tutorials - the formula above should not be new to you. You may have seen a different variant of this formula since, being an equation, it could be stated differently (eg. Equity = Assets - Liabilities)

If you have not heard of or seen this before let us now explore the role of the Accounting Equation.

Previously we’ve looked at the definitions of Assets, Liabilities and Equity. This helped us to understand what they are. The accounting equation helps us to understand how Assets, Liabilities and Equity relate to each other.

According to the equation, the sum of all the business Assets will always equal the total Equity and Liabilities.

Put another way: the value of all the cash, machinery, vehicles and other assets (Assets) will always be equal to the sum of the profits and monies contributed by the owners (Equity) and the monies borrowed from a third party (Liabilities).

Here’s how this makes sense: If a business buys a piece of equipment it can either use its own resources (cash or other assets), or the owner can contribute his personal Assets or it can turn to other sources for funding like Banks or a combination of the two.

Note: Assets, Liabilities and Equity are sometimes also referred to as ‘The Balance Sheet’. This is because a Balance Sheet is precisely that: a statement that reflects the Assets, Liabilities and Equity of a person or business on a particular day.

Examples

Let's look at some transactions to help understand this better.

Example 1 - The owner of a company deposits R50,000 into the business bank account.

This exercise is all about paying attention to the way transactions like these affect the balance sheet. Here’s the solution to the first one.

|

Assets = |

Equity + |

Liabilities |

|

+50,000 |

+50,000 |

0 |

Let’s analyse the effect this transaction has had on the Balance Sheet. Notice that Equity increased by R50,000. This is because the owner increased his stake in the business by R50,000. He is risking R50,000 more than before this transaction occurred.

Since cash is an Asset, the total Assets will increase by R50,000. The Business Bank Account has R50,000 more than it had before this transaction.

Let’s have a look at another transaction.

Example 2 - A loan taken out by the business for a delivery vehicle R55,000.

Here’s the effect on the Balance Sheet:

|

Assets = |

Equity + |

Liabilities |

|

+55,000 |

0 |

+55,000 |

Let’s analyse again. Taking out a loan increases the amount of money owed by the business to people outside the business (Liabilities). The effect is that Liabilities will increase by R55,000. Now that the company has a new delivery vehicle, Assets increase by the same amount, keeping the equation in balance.

Example 3 - Purchased goods from a supplier on Credit. These goods will be sold to customers at a Profit. The goods were delivered together with an invoice for R25,000. Payment will only be made within 30 days from the end of the month.

|

Assets = |

Equity + |

Liabilities |

|

+25,000 |

0 |

+25,000 |

Time to analyse. In the first instance, we receive the goods that will go into stock holding until we sell them or use them to manufacture goods.

There are many names used for this and you might have heard some of these before. Eg. stock, trading stock, inventory on hand to name a few.

So stock increases by R25,000. Stock is an Asset. Then we received an Invoice for the goods which means we owe our supplier money. Or at least since we are not paying for the stock immediately it must be that we still owe them the money. This means Liabilities increase by R25,000.

Example 4 - Paid R10,000 Salaries for the Month from Bank Account.

|

Assets = |

Equity + |

Liabilities |

|

-10,000 |

-10,000 |

0 |

Finally, we are spending money! So our bank account (our asset) decreases by R10,000. We had R55,000 and spent R10,000.

Salaries are expenses. Expenses decrease profits so Equity decreases by R10,000.

It is good to remember that the Trading Account, that is; the income(+) and expenses(-); form part of Equity. This will really help you make sense of things.

Example 5 - Sold Goods from stock (Value R20,000) for R35,000. Customer Paid via EFT.

|

Assets = |

Equity + |

Liabilities |

|

+35,000 -20,000 |

+35,000 -20,000 |

0 |

So this is a two-part transaction. First, we need to deal with the sale. Then we need to account for the cost of sales.

First the sale. Since we have R35,000 more cash in the Bank, Assets have increased. Sales have increased too. Therefore Equity increased by R35,000.

Now the cost of the sale. R20,000’s worth of stock in our stock store has been sold. So the effect this transaction had on the Balance Sheet is to decrease the value of the stock on hand. It also affects the Equity of the business in that it is the Cost of Sales. Cost of Sales decreases overall profit.

Example 6 - Spent R5,000 in cash on some Equipment.

|

Assets = |

Equity + |

Liabilities |

|

+5,000 -5,000 |

0 |

0 |

In this case, we are only working on one side of the equation. Since we are spending money from our Bank account our Assets decreased by R5,000. But we are buying equipment which is also an Asset. The result is that Assets increase by R5,000 as well.

A thorough grasp of the accounting equation will help to deal with transactions later on in our next accounting tutorials. I highly recommend you spend some time here before moving on.

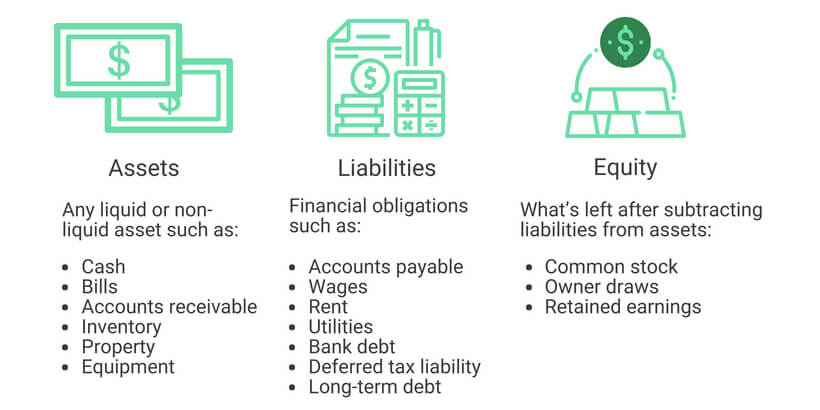

Assets, Liability and Equity

Most people have heard of assets, liabilities and equity. Especially when they had dealings with accounting at school, in a course, with accounting tutorials or when doing practical bookkeeping. It’s important to really understand these concepts since they are at the foundation of much of what we do in accounting.

Assets

What are assets?

For accounting purposes here is a good working definition of what assets are:

- Assets belong to the business

- Assets have a re-sale value or a cash value and

- Assets are usually used for the running of the business and generating income.

Some examples of Assets include cars, equipment or machines, land and buildings, cash in the bank, money owed to the company (debtors), patents or trademarks, and stock.

Distinctions are also made between different kinds of assets. Financial Statements will sometimes describe some assets as Fixed or as Current Assets.

Fixed Assets are Assets that a business is planning to hold on to for a long period of time. At least longer than 12 months. Of the examples listed above cars, equipment and machines, land and buildings fall into the Fixed Asset category.

Current Assets are those Assets that are much more short-term in nature. E.g. cash, debtors, and stock are all examples of Current Assets. Current Assets are either cash or assets that the company intends to convert into cash within a period of 12 months from the date it is reporting.

Liabilities

Think of Liabilities as money that the business owes to someone. This someone can be the bank, a supplier, SARS, the landlord, etc. This specifically excludes money owed to the owner himself.

Examples of Liabilities are Loans, Loans for Machinery or Cars (hire purchase agreements), Mortgage Bonds, Trade Creditors (people you buy things for business from eg. a shoe distributor), Tax Payable, and VAT.

Just as in the case of Fixed Assets, some Financial Statements will talk about long-term Liabilities and Current Liabilities. Long-term Liabilities are those debts that need to be repaid more than 12 months from the period being reported.

Current Liabilities are those debts that will be repaid within 12 months from the date being reported.

Equity or Owner’s Equity

Equity has quite a few definitions. Owners equity is those transactions that directly affect the owner.

This includes contributions made by owners, loans to and from owners and all income and expenses.

It is useful to think of all income and expenses as part of one big account called the trading account. And this trading account falls under the equities. More on this later when we deal with debits and credits.

Assets, Liabilities, Equity and the Chart of Accounts

Below is a standard set of accounts one would often find when using an accounting package. Go through them one by one and see if they seem familiar.

| Sales |

| Cost of Sales |

| Accounting Fees |

| Bank Charges |

| Commissions |

| Depreciation |

| Interest Paid |

| Levies |

| Motor Expenses |

| Salaries and Wages |

| Retained Income |

| Members Loans |

| Bank Account |

| Motor Vehicle – at cost |

| Accounts Payable |

| Stock on Hand |

| Accounts Receivable |

All of these Accounts (any account that you will ever come across) can be classified as either an Asset Account, a Liability Account or an Equity Account.

In other words, Accounts are really a more detailed view of what could really be shown as Assets, Liabilities and Equity. For example, in a Balance Sheet Statement, you have an item called Assets. Those Assets are then split into more detail like Bank, Stock, and Accounts Receivable..

Table of Commonly Used Accounts

Here is a table of commonly used accounts grouped by these three categories. Have a look at the table to see if it makes sense based on the definitions and examples given above.

Examples of Accounting Statements

The reports that follow are what accounting is all about. After the hard work of capturing Invoices, Receipts, Payments etc. is done, this is what we are looking for: all Financial transactions are recorded in a form that is easily understood. Here is a list of three popular ones.

Balance Sheet

A Balance Sheet statement is a snapshot of a business’s Financial Position on a specific day. In essence, this report says here’s what we own (Assets), here’s what we owe people (Liabilities) and here’s what the difference is (Equity).

Income Statement (or Profit and Loss Statement)

An Income Statement is a report on the trading activities of a business. These are commonly published for a year of trading. That means that this report tells us about the Income the business made and the Expenses that were incurred making that income.

Trial Balance

The Trial Balance is more of a standard report than a Financial Statement. It is a report that shows a summary of all Accounts and shows Debit or Credit balances for these accounts. That means everything. Not just trading accounts as in the case of the Income Statement and not just a summary of Assets, Equity and Liabilities as in the case of the Balance Sheet.

Trial Balances tend to be used by management and others like auditors. Published Financial Statements don’t include Trial Balances as one of the statements. Later on in this course, we will thoroughly cover the Trial Balance.

Debits and Credits

A brief history

It’s tricky to explain debit sides and credit sides without a little history which we're going to cover in our accounting tutorials. Initially, the Debit and Credit side refers to the parts on the page in a book called the Ledger. And a Ledger was a book that had many pages that looked something like this

Everything to the left of the centre was the Debit side and everything to the right was called the Credit side.

Accountants would assign a page in the book to each account (eg. a page for Rent, one for bank charges etc.). Each Ledger Account had a Debit side and a Credit side.

So imagine that you have just made an EFT to pay your landlord. To update your Ledger you’ll find the rent page and record the payment you made.

Then you would go to the Bank Account page and also record the same transaction there.

We obviously don’t do this anymore. However, the software we use today for accounting has largely been built around this paradigm.

So this begs the question, on which side would you have put the transaction in the Rent Account? And on which side would you have put the transaction in the Bank Account?

A rule to commit to memory

To be able to answer the question of which side of the Ledger we place these transactions, we need to follow the rules of accounting. Here’s the rule:

Assets increase on the debit side. Liabilities and Equity increase on the credit side.

Memorise this rule and it will help you to figure out it would be helpful.

Step by step to understand

Now let us walk through a few examples to help you understand how this works. While doing this I will highlight some questions you should be asking that will prove a useful framework for solving debit and credit questions.

Here’s our first transaction:

The owner deposits R50,000 of his own money into the business’ bank account. This is his contribution to the business.

First Question: What are the two accounts involved?

The two accounts are the Bank Account and the Owners Contribution Account.

Second Question: What kind of Accounts are these?

The Bank Account contains cash so it’s an Asset. And Owners Contribution is an Equity Account.

Third Question: What’s the effect on these accounts? (ie. are they increasing or decreasing)

Bank increases with R50,000. The business has R50,000 more cash than before this transaction. Since Assets increase on the Debit side according to accounting rules, the Bank Account of the business will have a Debit of R50,000. Owners Contribution (an Equity account) will also increase.

The question we have to ask ourselves is whether the Owners Contribution is more or less after the transaction in question. Or, another way of putting it, has the owner contributed more or has he withdrawn his contributions?

In this case, the account called Owner's Contribution has increased by R50,000.

Let’s look at another transaction for this business

The owner buys Equipment for the business to the value of R5,000. He paid via EFT from the business bank account.

Remember that, when analysing these transactions, we will answer those three questions again:

- What are the accounts affected?

- What kind of accounts are they (ie Assets, Liabilities or Equity)

- How are they affected? (increasing or decreasing)

The answer to the first question is Equipment Account and Bank Account.

To answer question two, they are both Asset Accounts

How are these accounts affected? Well, we spent some of the R50,000. Since Bank is an Asset and Assets increase on the Debit side, we need to Credit the Bank Account with R5,000 so that the Account decreases.

As a side note. At any given time if you want to know the balance in the account you would subtract Debit and Credits from each other and this will give you the balance. In the case above it is Dr of 45,000.

The second part of this transaction is the effect on the equipment account. Since the equipment is an Asset and with this transaction, we’ve increased the value of the Equipment the business has, there will be a debit to the Equipment Account with R5,000.

The most important items to take away from this article are the accounting rules around Debits and Credits and the also the 3-question framework for dealing with transactions. Master these and you are well on your way to being able to quickly assign Debits and Credits to accounts.

Let’s take it one step further by working through transactions that involve income and expenses.

Before we go on, let’s review the two components of the previous article. In order to solve any Debit and Credit question you need to remember the following:

- Assets increase on the Debit side and Liabilities and Equity increase on the Credit side.

- The 3-question framework:

- What are the accounts involved?

- What kind of accounts are they? (Assets, Liabilities or Equity?)

- How are they affected? (Increase or decrease?)

On to our first example:

Income and Expenses

Paid monthly Rent to Landlord via EFT.

Let’s run this transaction through the 3-question framework.

Q1. What are the accounts involved?

Bank Account and Rent Paid Account. Bank because the amount of cash in our account is affected, and the amount we spend on Rent is also affected.

Q2. What kind of accounts are they?

Bank is the easy one; it is an Asset.

Rent Paid? What kind of account is this? Let’s see. It’s not an Asset; we don’t have something that has value in itself, it can’t be sold for cash, nor is it cash itself.

It’s not a Liability; we aren’t increasing the amount of cash owed to people outside of the business like Banks, Suppliers or SARS.

By way of elimination, it must then be Equity. As we explained previously: Equity is a combination of money and/or Assets that the owner invests into the business, as well as the profits of the business’ activities.

A Brief Look at Business Activities: Profits or Losses

All businesses do something to make a profit. Profit is what you have left when you take the money you made in a certain venture and subtract the money you spent to make it. Eg. If you made R10,000 in selling shoes and it cost you R6,500 to make those sales, it means you’ve made a profit of R3,500.

Here are a few more examples of business activities:

A bakery buys flour, sugar, butter and other ingredients and sells cakes and bread.

A property company has properties and spends money on Repairs & Maintenance, Rates, Security etc. and in return, they receive a Rent Income.

A plumber has tools, then buys in parts and supplies and uses his expertise to make an income from charging customers to repair and install baths, toilets and showers.

Nominal Accounts

If we accept that Rent Paid is an Equity Account we can go on to answer the third question.

Q3. How are these accounts affected?

Bank decreases because we now have less cash than before. So we Credit Bank.

Take care as we move along here; there is a common error to avoid:

The wrong approach

The Rent Paid belongs to Equity. Equity increases on the Credit side. Therefore Rent Paid is Credited. But it would be incorrect to simply say Rent Paid is Equity.

The right approach

Rent Paid falls into the category of Equity because forms part of calculating profit or losses made by the business.

Think of Profit & Loss as a single ledger account but instead of having a Debit and a Credit side only, both the Debit and Credit sides have their own sub-Debit and Credit sides.

(This is, in fact, why accounts like Sales, Interest, Income, Bank Charges, Accounting Fees, Postage Expenses etc are referred to as Nominal Accounts. ie Not a real account.)

Expenses increase on the Debit side and Income on the Credit side.

Now it’s time to work through a few examples.

Example 1

Received interest on Bank Deposit of R50.

Q.1 What are the 2 accounts involved?

Bank and Interest Received.

Q.2 What type of accounts are these?

Bank is an Asset and Interest is an income (Equity).

Q.3 How are they affected?

Bank is increasing. This means a Dr of R50 in the Bank Account. Income (Equity) is increasing. This means a Cr of R50 to the Interest Account (Equity).

Example 2

Paid R500 cash for materials used in the manufacturing process

Q.1 What are the 2 accounts involved?

Bank and Cost of Sales.

Q.2 What type of accounts are these?

Bank is an Asset and Cost of Sales is Equity.

Q.3 How are they affected?

Bank is decreasing. This means a Cr of R500 in the Bank Account.

Cost of Sales (Equity) is increasing. This means a Dr of R500 to the Cost of Sales Account (Equity).

Example 3

Sold goods on Credit to a customer, R1,200. The customer will pay us in 30 Days.

Q.1 What are the 2 accounts involved?

Sales and Debtors.

Q.2 What type of accounts are these?

Debtors is an Asset and Sales is an Income (Equity).

Q.3 How are they affected?

Debtors are increasing because we are owed more money than before. This means a Dr of R50 in the bank account. Income (Equity) is increasing. This means a Cr of R50 to the Income Account (Equity).

Conclusion

Understanding that Expenses and Income Accounts are part of Equity is key to being able to deal with Debit and Credit problems.

Again, keep going over the examples in this article and the previous one to make sure that you understand the concepts being taught.

Double-Entry Method

In previous sections of our accounting tutorials, we touched on the Trial Balance. It is important that this report balances after every transaction. By balance, we mean that, in the case of the Trial Balance, the sum of all the Debits equals that of the Credits. This is one way we know that the accounting has been done correctly.

In this section and the next we will consider the double-entry method and we will explain how this happens.

All transactions in accounting must affect at least two accounts. This is the golden rule of double-entry accounting and what keeps the system balanced.

This is not the whole rule. There is another part to this that speaks about Debits and Credits. For now, though, let's forget Debits and Credits. Only think about accounts.

To understand the double-entry method and how it works let's look at a few examples.

Example 1

The owner of a new startup transfers R10mil to the business account for XYZ Printers (Pty)Ltd.

If all transactions affect at least two accounts, what effect would the above-mentioned transaction have on the accounts of XYZ Printers?

These exercises might be difficult initially but with some practice, the answers will come fairly easily. Usually the answer reveals itself by carefully thinking through the details of a transaction. Another way of thinking about it is to ask: What is different in the accounts of the business after the transaction?

In our example, the owner himself had put money into the business Bank Account. That means that the business has R10mil more in its Bank Account than before. Also, the business owes the owner R10mil more than it did before the transaction.

So the answer to the question of which accounts are affected is 1. Bank Account and 2. Shareholders Loan (Equity)

Let’s look at another example to help us understand the double-entry method.

Example 2

Sold printed goods to BBM Phones to the value of R4,500. BBM will pay this in 30 days.

Again we have to answer the question of which two accounts are affected. And to do so we can ask ourselves how the transaction has changed the accounts of the business.

Since we ‘sold goods’ the one account that is affected is Sales. That’s pretty straightforward.

The other account involved can be seen from the bit about ‘BBM will pay this in 30 days’. This means we give them the goods and instead of them giving us money in exchange, they give us a promise to pay us in 30 days. That’s what Debtors or accounts receivable are. Customers who give us a promise of payment.

What follows is a series of transactions that can be used to get some exercise in spotting the two or more accounts affected in an accounting transaction.

Name the two accounts involved in the following transactions.

- Bought stationery from a supplier. This was bought on account. You will only pay in 30 days.

- Paid R5000 towards a company car. This was a debit order.

- Bought food for an office function. This was paid by EFT

- Owner bought some paper for a job and paid for it from his personal Bank Account

- Bank debited the Bank Account with a monthly service fee of R200.

- Paid salaries into staff Bank Accounts. Payment made via EFT.

- Customer paid for a job that was printed. Paid by EFT. A 10% discount was given (tip: there are more than two accounts involved here.)

- An EFT was received from a customer as payment on his outstanding account.

It is important to have a good grasp of these concepts before moving on.

Answers

- Bought stationery from a supplier. This was bought on account. You will only pay in 30 days - Answer: Stationery and Creditors/Accounts Payable

- Paid R5000 towards a company car loan. This was a debit order - Answer: Bank and Car Loan

- Bought food for an office function. This was paid by EFT - Answer. Entertainment and Bank

- Owner bought some paper for a job and paid for it from his personal Bank Account - Answer: Cost of Sales and Members Loans

- Bank Debited the Bank Account with a monthly service fee of R200. - Answer: Bank Charges and Bank

- Paid salaries into staff Bank Accounts. Payment made via EFT. - Answer: Salaries and Bank

- Customer paid for a job that was printed. Paid by EFT. A 10% discount was given. (tip: there are more than two accounts involved here.) - Answer: Sales, Bank and Discount Allowed.

- An EFT was received from a customer as payment on his outstanding account. - Answer: Bank and Debtors/Accounts Receivable

VAT - What it is and how it works

Value Added Tax (VAT) is often a somewhat mystical concept.

In this tutorial, we offer a simple explanation that gets to the heart of what it is, how it works and how we deal with the accounting side of VAT.

What is VAT?

The simplest way to explain VAT is by way of an example.

In a world, with no VAT Mr Farmer sells his produce to Mrs Deli down the road. Mrs Deli uses this product in the food she sells to Joe Soap, the Software Consultant, who often has a bite to eat at the Deli.

Here’s what the accounting will look like: Mr Farmer sold his goods to Mrs Deli for R20, Mrs Deli then took these goods and turned them into lunch which she sells to Joe Soap for R100.

Inject VAT into this scenario and this is what it would look like:

Mr Farmer sells his produce to Mrs Deli for R22.80 (R20 with 14% tax added on top of it) because he is what they call a “VAT Vendor” which is basically someone who signed up to collect taxes on behalf of SARS.

So he adds VAT as a percentage on top of his selling price. Mrs Deli hands over R22.80 in cash rather than the R20 in the world without VAT. When Mrs Deli sells lunch to Joe Soap, since she is also a VAT vendor, she charges him R114 rather than R100.

Why would anyone sign up for a job as SARS’ little helper?

Well, there are two reasons for this. One is that VAT vendors are allowed to deduct the VAT that they are paying in producing their goods or services from the amount that they have to pay over to SARS.

The second reason is because of the law. Businesses whose income exceeds a certain amount must register for VAT. At the time of writing, the tax threshold here in South Africa was R1million turnover per annum.

Let us look at Mrs Deli’s business to see how this works. First, she buys ingredients and pays R22.80 in cash. (The R2.80 that she pays is called Input VAT.) She then uses these ingredients to make lunch. She sells a meal to Joe Soap and makes an income of R114. (The R14 she charges him is called Output Vat.)

At the end of every VAT period, in most cases this is bi-monthly, Mrs Deli needs to add up all the Output VAT and Input VAT. Then she needs to pay the difference over to SARS.

There are a few other complications such as inclusions, and exclusions but this should help you understand enough to go on to the next section.

How does VAT affect accounting?

Let's look at another basic sale and see how VAT impacts accounting.

Company A sells widgets to company B for R5,000. They pay via EFT.

What are the accounts involved?

Sales and Bank.

Once we add VAT, the amount the customer is charged and pays is R700 more than in the first example (5,000 vs 5,700).

The company’s sales are the same. This is because even though the customer owes R5,700 only R5,000 belongs to the business. The 700 that the business collects belongs to SARS.

A third account is added to the list of accounts affected. The transaction now affects Sales, Debtors and VAT control. The VAT Control Account keeps a running balance of the difference between VAT Outputs and Inputs. VAT Control Account is a liability. This means that this amount is owed to someone outside of the business. R700 is now owed to SARS.

Let’s add another transaction to this scenario. The company bought the widgets from Supplier A for R2,850 and paid via EFT. Our supplier is a VAT vendor. So the invoice shows R2,500 + R350 VAT.

The new transaction also affects three accounts. Cost of Sales, Bank, and VAT Control.

Let’s start with the Bank. We actually pay our supplier R2,850 in cash. So our Bank Account decreases by R2,850.

Cost of Sales is only affected by R2,500 because the R350 that was included in the payment to Supplier A will be deducted from the amount owing to SARS.

The VAT Control Account showed R700 owing to SARS before this transaction. Since we’ve added this transaction, this amount has decreased to R350. R700 less the R350 from our suppliers' payment.

VAT Report

Typically, if you are using business operating software, these reports are automatically generated while you capture receipts, payments, customer invoices, and supplier invoices.

These reports group inputs and outputs together and calculate how much is due to you or is payable to SARS.

Quickfire VAT Facts

You can only claim VAT on invoices that charge VAT.

If you claim VAT on an invoice you need to keep this document and make sure that the supplier has put your VAT number on their invoice.

Conclusion

VAT adds a very slight complexity to the basic accounting you’ve been learning so far. As in all things, sticking to the basics will help you navigate this easily.

Remember VAT is simply collecting money on behalf of SARS. In return, you get to claim VAT on some of your business expenses.

This means you need to keep track of all sales as well as all expenses you can claim.