5 Trusted Ways to Keep Small Business Accounting Simple

As a business owner for the last 18 years, I know how challenging it can be to manage your own accounting if you’re not an actual accountant yourself. For most small business owners the thought of business accounting is both intimidating and depressing. How are you supposed to find the time and resources to grow your business, drive production, handle staff issues, and handle the numbers as well?

Here are five trusted things that I do to run my business accounting, that will help you run yours simply, and hopefully with a lot less stress.

1. It’s a (15 min) Date!

Create a calendar or diary appointment for 15 minutes once a week for you to organise your accounts. That’s all. Just 15 minutes a week. You can make a fresh cuppa and by the time your tea is finished, your accounts will be up to date. This appointment takes priority and is not to be rescheduled. Client-work always feels more urgent than updating your accounts, but when you make the time to do this every week, you’ll feel your stress levels — now and at year-end — fall fast. You’ll also have more insight into your business and have everything ready when tax season comes all too quickly. Alternatively, you can use a system that automatically updates your accounts for you with every transaction, like QuickEasy BOS, in which case, you can just sit back and enjoy the tea break.

2. Step Away from the Spreadsheet

Probably the best advice I ever received (and have subsequently dished out) is to stop using spreadsheets to do my accounting. The first reason for this is, it makes your business vulnerable to human error. Secondly, it adds to your admin salary bill. Thirdly, it is incredibly manual, with very little system functionality.

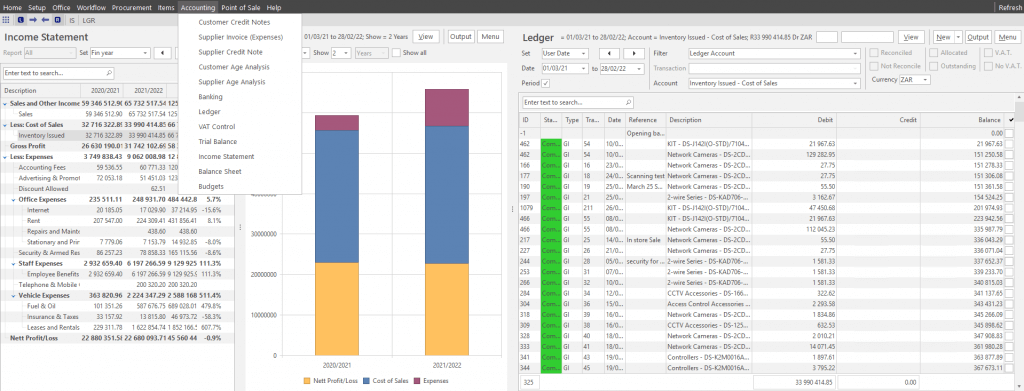

There are a host of stand-alone accounting systems that small businesses can choose from – ranging from free apps to more robust accounting packages – however, these can be somewhat complicated to use, and tend to be geared more towards accountants, not to business owners.

Most accountants are looking for this functionality in software, so you won’t go wrong if you look for business software that does the following, plus the added benefit of being easy to use:

- Can it import directly from your bank account?

- Does the ledger have unlimited accounts? Interactive views would be a plus.

- Can you do audits and close-off dates?

- Can it email bulk statements, invoices and personalised reminders?

- Does it have VAT control, trial balance, income statement and balance sheet?

- Can it export to excel or another accounting package?

Don’t be intimidated by this list. As a business owner, access to this accounting information is sufficient to steer the ship. Ultimately, the more integrated your business software is with your entire business, the more automated your accounts can be, and can pull live data from every stage of the business process – from quoting, to production to invoicing – into meaningful accounting. Perhaps then, the better, the more sustainable option might be to use an ERP system that has accounts functionality as well as all the other business functions, as opposed to just an accounts system.

3. Don’t Mix Work with Pleasure

Sure, you started a business so that you could enjoy a certain lifestyle, but buying those new shoes with the company credit card, or paying for your kids’ school outing with the business cheque card is probably creating havoc in your books. Even though you promise yourself you will pay it back to the business later if you’re going to do it right, you need to keep things separate. Save yourself hours of work and make it easy to keep track of expenses by keeping two separate accounts: one for business and one for personal.

4. Call a Friend

There are times when you need an expert to do the big stuff, like your business tax. For that, we suggest going with outsourced financial services all the way. It is a minimal expense, compared to paying a monthly salary bill for a full-time employee. Plus, it frees you up from trying to do everything yourself and making a few blunders, so that you can get to the important stuff – like running your business. They have way more experience, training and expertise in this area, and the clean data you give them from your ERP system will keep their billable hours short, and more affordable. More often than not they will also find more deductions and keep you penalty-free. So, when things get technical or taxes are due, save yourself the money and the stress headaches and call in a trusted professional.

5. Have Your Cake, and Get Paid For It Too

This might seem pretty obvious, but too many small business owners have difficulty knowing how many invoices have gone out, if everything they’ve done has been invoiced accurately, or if customers have paid. It could be months before you realise you have outstanding invoices if you’re not keeping proper records. Make sure you are properly tracking all payments due and recording when each invoice is paid. Your accounts and ERP system should show you at a glance what invoices are outstanding, how long customers generally take to pay, and which customers you’ve had difficulties collecting payments from historically. This way, you will run your business smarter, leaner, and more profitably.